US Presidential Election Reaction: US dollar soars on blowout Trump election victory

- Go back to blog home

- Latest

The US dollar has rallied against almost every currency in the world overnight, as investors digest the news of the big outperformance in the polls from Donald Trump.

A Trump win began to be priced in relatively early on in the night, as the initial suggestions were that the Republicans had once again performed better than anticipated. The rally in the dollar picked up pace as the night progressed, as the early results showed that Trump was performing well in the key battleground states, which hold the key to victory in the electoral college system. Indeed, by as early as around 3.30am GMT, bookmakers were pricing in north of a 90% chance of a Trump win, and EUR/USD had crashed towards the 1.07 level.

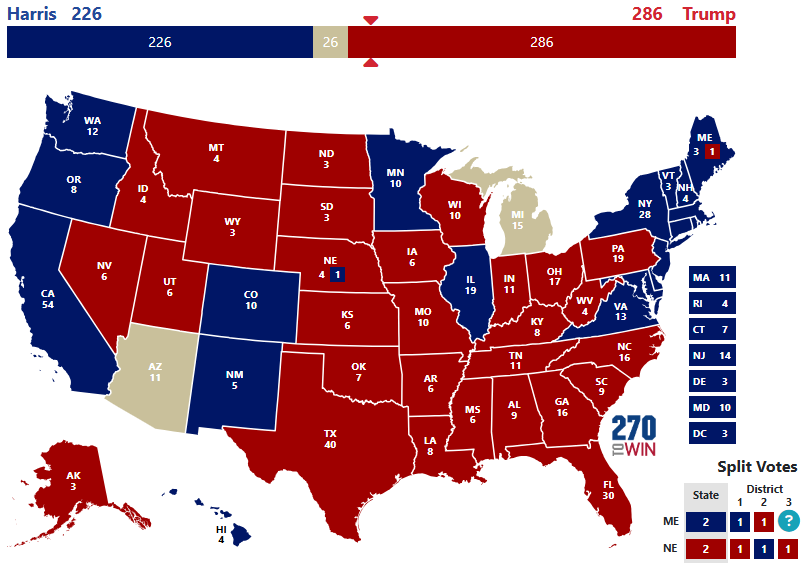

As the results in the swing states continued to roll in, it became abundantly clear that there was no way back for Kamala Harris and the Democrats. North Carolina (4:40 GMT) and Georgia (05:37) were the first of these seven crucial states to be called and, by that stage, Trump was ahead in all other states and essentially guaranteed victory. Perhaps the last nail in the coffin for Harris came at just after 7am UK time as Pennsylvania, which was seen as the biggest battleground of them all, was declared Republican territory.

At the time of writing, Trump has obtained 266 electoral college votes, compared to 219 for Kamala Harris, with 7 states left to declare. Yet, an unassailable lead in many of the remaining states ensures that it is merely a matter of time before he officially holds more than the 270 electoral college votes that he requires for the presidency.

US Electoral College Map (as of 09:00 GMT, 06/11/24)

Currency markets reacted in line with our expectations leading into the election, with the dollar rallying against almost every currency globally as a Trump win became clear. The euro was the worst performer among the major currencies, as investors braced for onerous European tariffs and a heightened security risk. Trading in relative lockstep has been the Japanese yen that, while a traditional safe-haven, is highly exposed to the prospect of a widening in US rate differentials. As we had anticipated, sterling performed slightly better than the common currency, in part due to its lower exposure to global demand. The Australian and New Zealand dollars, the two G10 economies that we see as the most acutely exposed to Chinese demand, underperformed initially, before recovering ground.

G10 FX Performance Tracker (06/11/24)

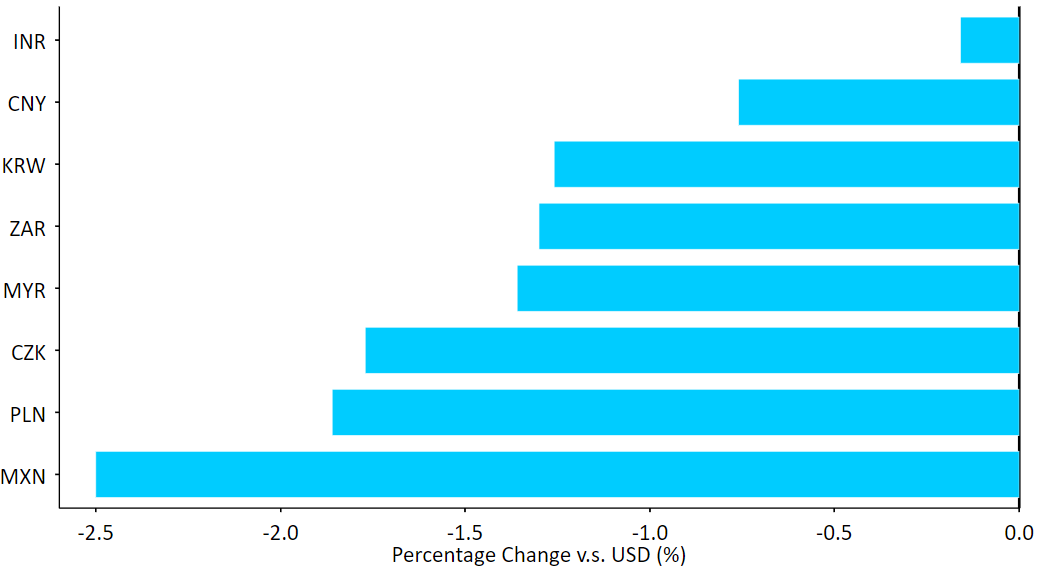

Emerging market currencies bore the brunt of the sell-off. As in 2016, the Mexican peso (-2.5%) led the move lower, which is no surprise given Trump’s hostile rhetoric towards the Latin American nation, which is likely to be hit by hefty import taxes. The currencies in Central and Eastern Europe were also battered, again partly amid fears over European security, and the sell-off in EUR/USD. The high-risk Hungarian forint (-2.0%) was the laggard in the region, with the Polish zloty (-1.9%) and Czech koruna (-1.8%) also trading sharply lower.

We’ve seen aggressive moves lower in the Asian currencies, particularly those that have the closest trade links with China, notably the Thai baht (-1.8%) and Malaysian ringgit (-1.4%). One of the main ramifications of a second Trump stint in the White House will be a return to his protectionist policies, and markets are sure to brace for weaker growth in the Chinese economy given his plans to slap 60% tariffs on imports from Asia’s largest economy. The yuan itself has held up better than its peers (-0.8%). Again, this is not surprising given that Chinese authorities keep a tight leash on the currency, limiting moves in either direction.

EM FX Performance Tracker (06/11/24)

Aside from the presidential vote itself, Americans also went to the polls to decide on the composition of Congress, the US government made up of the Senate and the House. This is highly important for the incoming president, as it determines their ability to enact policy changes, particularly on the domestic front. Here, the Republicans were able to regain control of the Senate, as was almost universally expected. The race for the House was a much more closely contested affair, although this also looks set to be going the way of the Republicans with results left to declare (currently 93% chance according to Polymarket).

What has been behind the US dollar rally?

As we outlined prior to the election, markets are clearly taking the view that another spell in the Oval Office for Donald Trump is a bullish development for the US dollar. We see this as largely a consequence of the below:

- Trump’s preference for lower US tax rates. Proposals for sweeping tax cuts under president Trump, which are far more likely to pass under a GOP clean sweep, are seen as lifting near-term US growth, while leading to higher inflation and, most importantly for markets, higher Federal Reserve interest rates.

- Greater protectionism means higher US tariffs, particularly on China and Europe. The implication here is that these tariffs could be a precursor to weaker global growth under Donald Trump. This is a scenario that would see investors favour lower risk assets, including the dollar itself, at the expense of higher risk currencies, notably those that are acutely exposed to the global economic cycle.

- Another Trump term may ensure higher geopolitical uncertainty, which is also not favourable for risk appetite. Support for Ukraine is not guaranteed, nor does Trump hold a particularly favourable view towards NATO.

EUR/USD (05/11/24 - 06/11/24)

What can we expect in FX in the coming days?

So far, we would perhaps argue that the moves in the FX market have been somewhat contained relative to expectations from some quarters. It is very early days, however, and we would expect volatility to remain elevated in the next few trading sessions, as investors position themselves in anticipation of another Trump presidency. This could mean fresh downside in risk assets and another bout of dollar strength, particularly should the Federal Reserve hint to markets at upcoming policy meetings, potentially on Thursday, that the outcome of the election may slow the pace of the Federal Reserve cutting cycle.

For now, of course, nothing changes. President Biden will remain in the top job until early next year, and we will have to wait until 20th January 2025 for Trump’s inauguration. His rhetoric in the meantime will be closely watched by market participants. Commentary that doubles down on his tariff threats and tax cuts could conceivably exert some additional upward pressure on the greenback, as investors pencil in weaker global growth and a higher terminal Federal Reserve interest rate.