Here, we present a structured approach to assist fund managers when acquiring assets denominated in a currency other than the fund’s base currency to evaluate their Foreign Exchange (FX) exposure and assess if and how to manage its currency risk.

Assessing the need for currency hedging

There is no single answer as to whether a fund should hedge its currency exposure. A fund will consider multiple factors in deciding if it’s best to hedge, and, if so, how. Factors a fund manager will consider will be the asset type, the relative size of the exposure, when an exit will happen, the investor mandate, the cost of hedging, and the size of FX uncertainty relative to the expected Internal Rate of Return (IRR). Often, the rationale for choices ‘whether to hedge’ and ‘how to hedge’ impact each other, making clear decision-making complex.

A structured approach to evaluating currency risk

To help fund managers evaluate choices while considering ‘whether to hedge’ and ‘how to hedge’ when acquiring assets denominated in a currency other than the fund’s base currency, we look in detail at the 4 dimensions:

- Chance of FX exposure impacting IRR: How material would a negative currency move impact IRR?

- IRR certainty: What is the probability an investment will return the IRR objective?

- Exit timing predictability: How much visibility is there on the timing of an exit?

- Exit currency: Is an FX transaction likely at exit?

Let’s take a deeper look at each of the dimensions.

1. Chance of FX exposure impacting IRR

How material would a negative currency move impact the Internal Rate of Return (IRR)?

- The size of a foreign-denominated asset versus a fund’s total net asset value combined with the extent of potential moves in FX results in an estimation of potential FX losses that might be incurred.

- An FX exposure is deemed material if an FX loss exceeds a fund’s risk tolerance.

- The potential size of FX moves of a currency pair is often estimated using historical patterns or currency option prices.

2. IRR certainty

What is the probability an investment will return the IRR objective?

- Different fund strategies come with different degrees of certainty around investment IRR. Private Equity (PE) investing in mature companies tends to have a higher degree of certainty on investment outcomes than, for instance, Venture Capital (VC).

- The odds that a single investment will pay off are relatively low for VC funds, which typically generate their overall returns from a handful of highly successful investments.

- The uncertainty around an individual investment’s likelihood of success can make it difficult for VC funds to hedge currency risk efficiently. On the other hand, PE, which focuses on mature assets, is better suited to pursue FX hedging strategies.

3. Exit timing predictability

How much visibility is there on the timing of an exit?

- Funds focusing on seed, series A, and series B investments may have less or limited visibility into their exit timing. Later-stage investors, fund-of-funds, real estate, and credit funds have a greater line of sight regarding the timing of their exits.

- Likewise, funds with a presence on a portfolio company’s board have insight into the type of exit and timing.

- All else being equal, greater visibility into a potential exit may make hedging currency risk more viable.

4. Exit currency

Is an FX transaction likely at exit?

- A fund-of-funds investor that invests in a fund denominated in the British pound (GBP) will be paid investment returns in GBP.

- A fund investing in biotech might exit through a US IPO, so the funds may receive their returns in USD.>

- Later-stage PE might exit an investment by selling to another private equity firm, selling to a strategic acquirer or floating on the stock market, all of which may impact the currency realised by the fund.

Applying the four dimensions to make a hedging decision

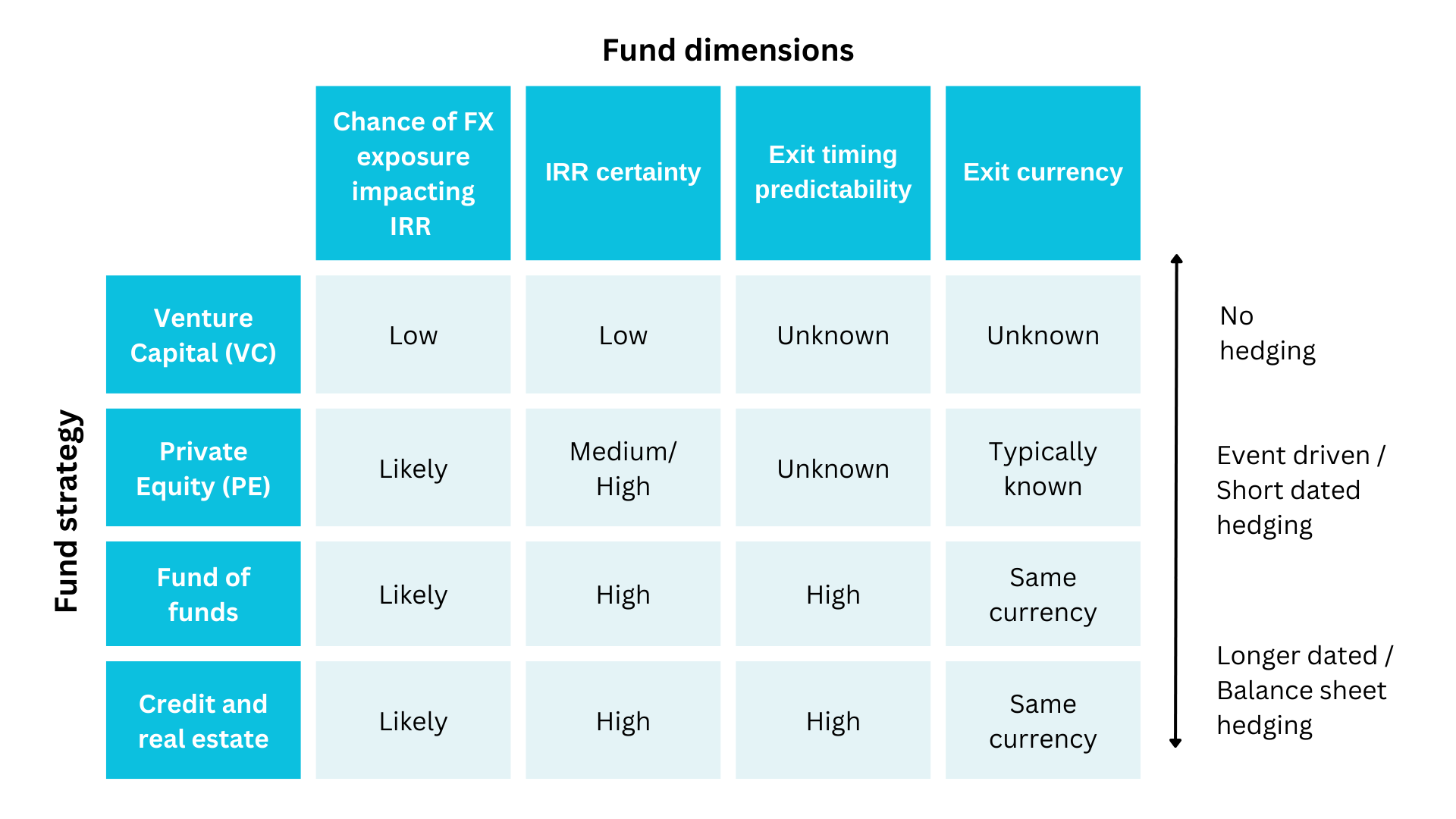

By evaluating a fund’s strategy and specific investments against the four key dimensions, fund managers can gain insights into the necessity and potential benefits of implementing currency risk management strategies. The table below summarises how different types of funds typically approach this process.

Our observations support that a higher percentage of fund of funds (FOF) investors and credit funds hedge their currency risk. The greater use of hedging is likely appropriate for these funds, considering the materiality of their currency risk, the likelihood of investment success, visibility into exit timing, and nature of their exits.

Common FX hedging strategies employed by fund managers

Managers often use FX forward contracts to hedge against currency movements. Forwards enable funds to lock in a predetermined exchange rate at which foreign currency will be converted to the home currency at a predetermined date. The forward represents an obligation to an amount and to a time.

Exit date uncertainty is often addressed by rolling short-dated (1 to 3 months) FX forwards. PE managers who face uncertain exit timing most often deploy a strategy of rolling short-dated forwards. A rolling short-dated hedging strategy removes the spot FX risk but keeps the fund exposed to changes in the difference in interest rates between the hedged currencies (interest rate differential).

Funds of funds, real estate, and credit funds typically have a higher likelihood of investment success and a higher degree of visibility into exit timing. Hence, they use longer-dated forwards with a tenor that sufficiently covers the expected holding period of the asset. Opting for a longer-dated forward strategy requires a greater credit line to enter into but limits exposure to changes in the interest rate differential.

Benefits of using Ebury Institutional Solutions for currency risk management

- Access wide-ranging FX hedging instruments to support fund managers.

- Support in setting up a FX hedging strategy and choosing suitable FX instruments.

- Offer long tenor forwards enabling hedging up to the expected exit date

- Limit cash drag impact by requiring no or low collateral to set up and maintain FX hedges.

Let’s start a conversation

Get in touch with our experts to discuss the needs of your fund and how Ebury can help you. You can also visit our page to learn more about our solution.

Disclaimer

- The information provided herein is general in nature and should not be construed as financial or investment advice. The information provided here is not legally binding.

- The information, data or views expressed here is for the exclusive use of the recipient and is subject to changes without any notice. You may ask the support team or your dedicated relationship manager to provide additional information regarding Ebury Partners Australia Ltd products.

- For more details, please refer to our legal and privacy notice.